External Accounts

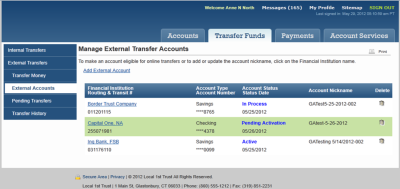

Before an external account (also called an “external transfer account”) can be selected for an external transfer, you must use this function to add, update (if appropriate), validate, and activate the account. To begin this process, click the External Accounts navigation link that displays under External Transfers to request the Manage External Transfer Accounts page illustrated below. This page lists all the external accounts before each account is validated and activated for external transfers.

When the Manage External Transfer Accounts page displays, you may start any of the following procedures:

-

Adding an External Account – Set up or add one of your external accounts that you want to use for external transfers at another financial institution.

-

Updating an External Account – Allows you to update the account nickname for any external account listed on the Manage External Transfer Accounts page with an Account Status of “In Process” or “Active.”

-

Validating & Activating an External Account – Allows you to validate and activate each external account listed on the Manage External Transfer Accounts page with an Account Status of “Pending Activation.” After this procedure is completed successfully, the external account is removed from the page and may be selected for an external transfer as described in the Mobile Banking section.

Note: External transfers are available on mobile devices through CheckFree RXP/TransferNow integration only.

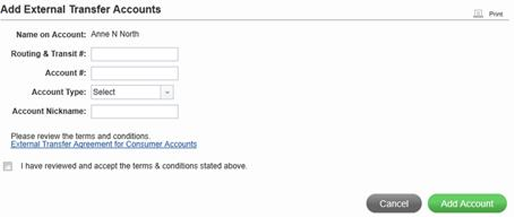

Click the Add External Account link at the top of the Manage External Transfer Accounts page to request the Add External Transfer Accounts page illustrated below. You may use this page to add a new external account (i.e., one of your accounts at another financial institution) that you want to use for external transfers.

Enter the following data on this page to add an external transfer account.

Name on Account

Displays your name (cannot be changed).

Routing & Transit #

Type the routing number for the external financial institution. If the financial institution has multiple routing numbers, enter the number that applies to the external account identified below.

Account #

Type the account number of the external account that you are adding.

Account Type

Select either Checking or Savings from the dropdown.

Account Nickname

Type a nickname to easily identify this account in your external transfer lists.

After all of the required information has been provided, you must review and accept the terms and conditions for use of the External Transfers feature. To view these conditions, click the External Transfer Agreement for Consumer Accounts link. To indicate acceptance of the terms and conditions in this agreement, select the I have reviewed and accept the terms and conditions check box. You may then click the Add Account button to add the external account or Cancel to cancel this process and return to the Manage External Transfer Accounts page.

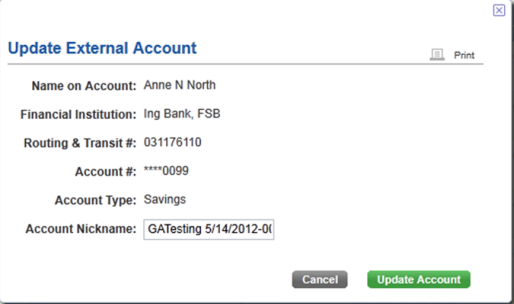

This procedure may be performed to update any external account listed on the Manage External Transfer Accounts page with an Account Status of “In Process” or “Active.” Click the link that displays as the name of the financial institution for the external account to request the Update External Account page illustrated below. You may then update the account nickname listed for the external account.

Enter the new Account Nickname and then click Update Account to change this field or click Cancel to cancel this process and return to the Manage External Transfer Accounts page.

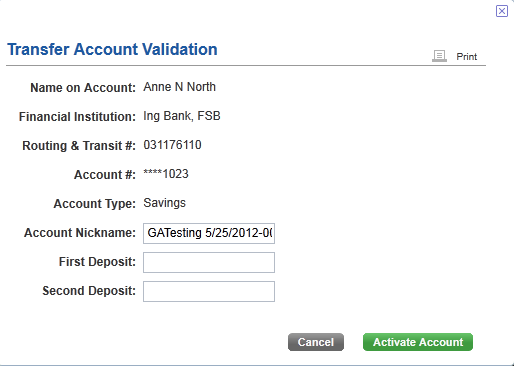

This function allows you to validate and activate each external account listed on the Manage External Transfer Accounts page with an Account Status of “Pending Activation.” After this procedure is completed successfully, the external account is removed from the page and may be selected for an external transfer as described in the Mobile Banking section.

Before making each external transfer account available for transfers, your financial institution first validates that the account is valid and eligible for transfer activity by processing two (2) small dollar transactions for the account. This usually takes 2-3 business days while “In Process” displays as the Status for the account. After the account is verified at the external financial institution, the Status of the account is updated to “Pending Activation”. You may then complete the validation process by confirming the two deposit amounts.

To confirm the two deposit amounts, you must view the transaction history for the account at the external financial institution to obtain the exact amount of each validation deposit. Next, return to the Manage External Transfer Accounts page and click the link that displays as the name of the financial institution for the external account to request the following page. You may then enter the exact amount for each of the two deposit amounts to validate that you can access the account at the external financial institution.

After entering both deposit amounts correctly in the First Deposit and Second Deposit fields, click Activate Account to complete the validation process and make your external account eligible for transfers. The account is then available for selection on the External Transfer account lists. You may also click Cancel to cancel the validation process and return to the Manage External Transfer Accounts page.